EMR, or Experience Modification Rate, is the most direct method of determining the effect that claim history has on the annual premium a business pays for workers’ compensation insurance. In technical terms, it is defined as follows.

The adjustment of annual premium based on previous loss experience. Usually three years of loss experience are used to determine the experience modifier for a workers’ compensation policy. The three years typically include not the immediate past year, but the three prior. Source: http://en.wikipedia.org/wiki/Experience_modifier

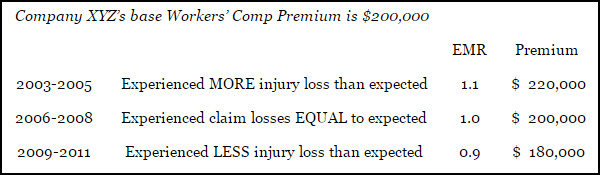

An average Workers Comp EMR rate is 1.0. In essence, an average EMR means that the actual losses during a 3 year period is equal to the expected losses for that period. Since EMR functions as a multiplier, a company with an average EMR rate will pay precisely the calculated premium based on industry, number of employees, and other risk factors. From a work safety perspective, it would appear that these companies are effectively but not optimally preventing work injury hazards that drive EMR risk.

A Sample Workers Comp EMR Calculation

Workers’ comp EMR rates are lower or higher if a business incurs total losses that are lesser or greater than expected losses in the applicable 3 year time period. For example, a company with more losses than expected may have an EMR of 1.1, and thus their premium is 1.1 times the base premium for their business. At the same time, if that business experiences fewer losses over the next 3 year period, their EMR may be 0.9 and they will pay less than the base premium.

Minimum Workers’ Comp EMR and Controllable EMR

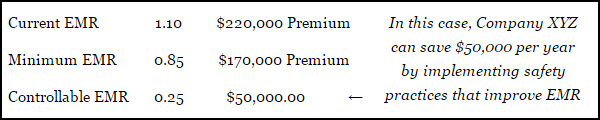

EMR values can and often do vary more than 0.1 above or below average. Each business has a minimum EMR that they can strive to reach in order to pay their lowest possible workers comp insurance premium. If Company XYZ has a Minimum EMR of 0.85 and a current EMR of 1.1, they have a Controllable EMR of 0.25 [1.1-0.85]. Here is where the bottom line effect should get the attention of business owners, as seen below.

Effective Safety Reduces EMR Risk and Saves Money

Effective work safety and EMR risk management has many positive effects. Improved morale, hiring and employee retention advantages, lost time reductions, and project timeline improvements to name just a few. While these factors are difficult to monetize, the bottom line effect of improved workers comp EMR and resulting workers’ comp premium savings illustrates how effective safety can be at providing long term profit advantages and improved cash flow. It’s clear that from a financial perspective, managing work safety is a win-win for businesses of all sizes or strategies.